What does Kwasi Kwarteng’s stamp duty cut mean for homebuyers in England?

Stamp Duty (SDLT) is a tax that is charged when you purchase a property or land over a certain price in England and Northern Ireland.

The recent cut to stamp duty tax announced on 23 September 2022 was part of a wider “mini budget” announced by the new Chancellor, Kwasi Kwarteng. The government announced this cut as what they describe as: part of their commitment to an economy based on high growth and low tax, to help people keep more of the money they earn and drive business investment as a result. The cut in stamp duty was one of Liz Truss’ promises when she ran to be the new leader of the Conservative Party.

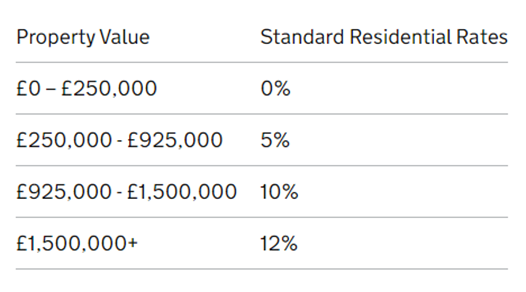

To help achieve these aims, the government cut Stamp Duty Land Tax for those purchasing a residential property, by doubling the level at which people begin paying this from £125,000 to £250,000.

In order to assist first-time buyers the government has also increased the level at which first-time buyers start to pay tax, from £300,000 to £425,000. They are also allowing first-time buyers to access the relief when they buy a property costing less than £625,000, rather than the previous £500,000 limit. The government has released these measures as part of their commitment to helping first-time buyers get onto the property ladder.

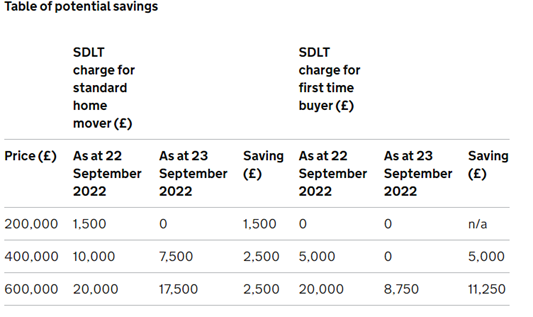

Government figures suggest these new measures will, on average, reduce stamp duty liability across the board for all movers by up to £2,500, with first-time buyers able to access up to £8,750 in relief.

The government hope these measures will boost the property market, in turn helping businesses expand and help fuel the wider economy’s growth.

What are the Potential Savings?

Below is the government’s table of potential savings:

The new standard Stamp Duty Land Tax rates from 23 September 2022 are now as follows:

What About Second Homes?

Those buying second homes or buy-to-let properties will continue to pay extra tax. In England and Northern Ireland this is known as a surcharge which is charged at a rate of 3% on top of the normal tax bands, which are shown above.

Expert Opinions on These Changes

To date the reaction from the property experts has been mixed, some saying it will ease the cost pressures whilst others fear this will cause house prices to spike.

Since the announcement of the “mini budget” it has prompted financial market volatility, and many lenders have been struggling to accurately price their products after the pound fell to a new low. This sent the interest rate to a 12 year high, brokers predicted this to be the start of a major shift in the UK mortgage market. It was announced that rates have increased by four times, the fastest rate on record since the announcement on the “mini-budget” as a whole, with rates now above 6% (based on an average five year fixed mortgage deal), compared to 2.35% a year ago.

There is considerable market un-certainty at the moment and it will be interesting to see how the property market adapts and adjusts to the current financial market conditions.

You can listen here to our podcast - common questions asked when buying a property. In this episode, Cassie and Emma discuss the common questions they're asked by people looking to buy a property, along with the steps they take to secure a smooth transaction. Please note the SDLT thresholds mentioned in this podcast have since changed.

If you have any questions in terms of your stamp duty liability then please do not hesitate to contact us.

This blog only applies to properties in England and Northern Ireland. Wales and Scotland is subject to Land and Buildings Transaction Tax which has its own set of rules and rates.

"*" indicates required fields

Back

Back